El Salvador has made a bold move to attract foreign investment by eliminating income tax on overseas investments and remittances. This significant decision comes as part of President Nayib Bukele’s efforts to stimulate capital inflows and encourage wealthy individuals to invest in the Central American nation.

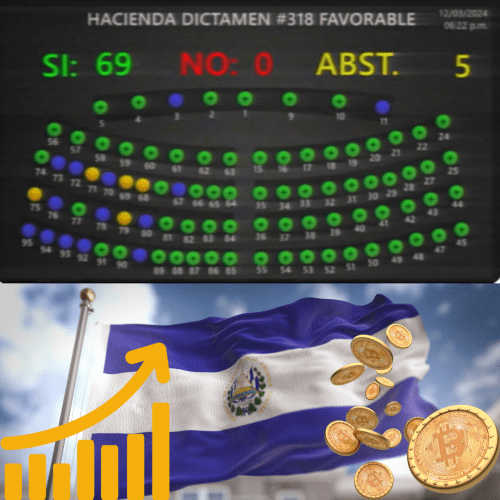

The decision was ratified by the Congress with an overwhelming majority, voting 69 to zero to slash the income tax rate from 30% to 0%, with five abstentions. This move applies to all amounts of money brought into the country, without any restrictions.

President Bukele, who recently secured a second five-year term in office, aims to bolster El Salvador’s economic growth and stability through these measures. However, neither the government nor the Congress has provided an estimate of the fiscal impact of this tax cut.

El Salvador’s attractiveness to foreign investors has been on the rise, especially since President Bukele’s initiatives such as legalizing Bitcoin as a legal tender. Additionally, the government’s efforts to combat crime have led to a significant decrease in the homicide rate, further enhancing the country’s appeal to foreign nationals.

Despite these positive developments, El Salvador’s dollar-denominated bonds have faced downward pressure in recent weeks amid uncertainty over a potential agreement with the International Monetary Fund (IMF). Despite credit rating upgrades by S&P Global Ratings and Fitch Ratings, El Salvador’s sovereign debt remains in speculative, or “junk,” territory.

This tax elimination comes at a crucial time for El Salvador as it seeks to attract foreign investment and bolster its economy. The government’s bold steps reflect a proactive approach to economic policy, aiming to position the country as an attractive destination for international capital.